What Year Pennies Are Worth Money and How to Invest in Them?

.Penny collecting, formally known as cent numismatics, appeals for several interrelated reasons grounded in history, economics and cultural heritage.

From a historical perspective, pennies reflect changes in national iconography, minting technology and political sentiment. Designs such as the Indian Head cent (1859–1909) and the Lincoln Wheat cent (1909–1958) document over a century of evolving artistry and symbolism. Composition changes—like the switch from bronze to zinc-coated steel in 1943—also mark periods of economic or wartime necessity.

Economically, certain pennies hold significant intrinsic and market value due to low mintages, die varieties and minting errors. Examples include the 1909-S VDB Lincoln cent, prized for its limited San Francisco production, and the rare 1943 copper cent, a striking error from the World War II era.

Many collections begin as inherited albums, sparking interest through family history. Completing a date-and-mint mark set offers a structured and rewarding challenge, while roll searching and attending coin shows provide a social dimension to the hobby. The small size, durability, and continued circulation of certain series also make pennies one of the most accessible entry points into numismatics.

But what year pennies are worth money?

Key U.S. Pennies Worth Money

Year & Variety | Type / Series | Mintage | Circulated Value* | Uncirculated Value* |

1877 | Indian Head | 852,500 | $800–$1,200 | $3,000+ |

1909-S | Indian Head | 309,000 | $300–$600 | $1,200+ |

1909-S VDB | Lincoln Wheat | 484,000 | $700–$1,200 | $5,000+ |

1914-D | Lincoln Wheat | 1,193,000 | $250–$400 | $2,500+ |

1922 No D | Lincoln Wheat | Unknown** | $500–$1,200 | $12,000+ |

1931-S | Lincoln Wheat | 866,000 | $75–$125 | $200–$250 |

1943 Copper | Lincoln Wheat | 20–30 known | $100,000+ | $200,000+ |

1944 Steel | Lincoln Wheat | 25–30 known | $75,000+ | $150,000+ |

1969-S Doubled Die Obverse | Lincoln Memorial | Unknown | $15,000+ | $40,000+ |

1972 Doubled Die Obverse | Lincoln Memorial | Unknown | $250–$400 | $1,500+ |

1983 Doubled Die Reverse | Lincoln Memorial | Unknown | $150–$250 | $800+ |

1992 Close AM | Lincoln Memorial | Unknown | $1,500–$2,500 | $20,000+ |

1995 Doubled Die Obverse | Lincoln Memorial | Unknown | $50–$75 | $400+ |

*Values are approximate and assume coins are genuine and properly graded.

**Exact mintage for varieties like the 1922 No D is unknown, as it was a die error within the year’s production.

How to Understand That Your Penny Is Valuable?

To determine whether a penny is valuable, you need to look at four main factors: date, mint mark, condition, and unique characteristics such as errors or varieties.

1. Check the date and mint mark

Rare pennies are often from years with low mintages or special varieties. The mint mark—found under the date—tells you where it was made: “P” (Philadelphia), “D” (Denver), “S” (San Francisco), or, for older coins, no mark for Philadelphia. Certain date/mint mark combinations, like the 1909-S VDB or 1914-D, are highly sought after.

2. Examine the condition

Coins in better condition are worth more. Grading runs from “Poor” to “Mint State” (MS), with higher grades showing no wear. A penny with sharp details, strong luster, and no damage can be worth many times more than the same coin in worn condition.

3. Look for errors and varieties

Double dies, off-center strikes, wrong planchet errors, and unique design variations like the 1992 Close AM can increase value dramatically. These often require magnification to confirm.

4. Confirm authenticity and market demand

If you think your penny is rare or high-value, compare it to images and listings in trusted coin catalogs or databases (PCGS, NGC, Red Book). For expensive coins, professional grading and certification is essential—this protects value and makes selling easier.

Professional Penny Coin Investment Plan

1. Define Your Investment Goals

Time horizon: Penny coin investments are best suited for a 5–15 year holding period.

Return objective: Aim for a blended annual growth rate of 5–10% through appreciation in key-date and high-grade coins.

Risk tolerance: Rare coins are less volatile than stocks but require patience; liquidity can be slower for niche pieces.

2. Build a Diversified Penny Portfolio

a. Core Holdings — Key Dates & Varieties

Focus on coins with consistent demand and limited supply:

1909-S VDB Lincoln Wheat cent (PCGS/NGC MS63 or higher)

1914-D Lincoln Wheat cent (VF-XF minimum grade)

1922 No D Strong Reverse (AU or better)

1931-S Lincoln Wheat cent (MS64 or higher)

1943 Copper cent (any grade; extremely rare)

b. Growth Holdings — Semi-Key & High-Grade Moderns

High-grade Indian Head cents from the 1880s–1900s (MS63+)

MS67+ graded Wheat cents from common years (low population)

Modern errors and low-population Lincoln Shield cents in MS68+

c. Opportunistic Holdings — Errors & Varieties

1969-S Doubled Die Obverse

1972 Doubled Die Obverse

1983 Doubled Die Reverse

1992 Close AM

3. Acquisition Strategy

Buy certified coins from PCGS or NGC to ensure authenticity and protect resale value.

Purchase through trusted channels: major auctions (Heritage, Stack’s Bowers), ANA-affiliated dealers, and vetted online platforms like GreatCollections or VCoins.

Track market prices via PCGS CoinFacts, Greysheet, and recent auction archives to avoid overpaying.

4. Holding & Storage

Store in climate-controlled conditions using inert holders or slabs; avoid PVC flips.

Keep an inventory log with purchase dates, grades, serial numbers, and costs for each coin.

Insure the collection through a specialty collectibles insurance provider.

5. Exit & Profit Strategy

Sell during periods of heightened demand (e.g., anniversary years, numismatic bull markets).

Use auction houses for rarities and online marketplaces for mid-tier coins.

Consider gradual liquidation to avoid flooding the market with similar pieces.

6. Risk Mitigation

Avoid raw high-value coins unless personally vetted by an expert.

Spread investments across series, dates, and grades to reduce exposure to single-market fluctuations.

Maintain liquidity reserve by holding a portion of coins in easily sellable, high-demand grades.

Penny Coin Investment Matrix

Budget Level | Core Holdings (60%) | Growth Holdings (25%) | Opportunistic Buys (15%) |

$5,000 | $3,000 — 1909-S VDB (MS63BN) or 1914-D (XF40–45) | $1,250 — MS66–67 common-date Wheat cents, choice AU Indian Head cents | $750 — 1972 DDO, 1983 DDR, high-grade Shield cent errors |

$10,000 | $6,000 — Mix of 1909-S VDB (MS64BN), 1914-D (AU55), and 1922 No D (VF30+) | $2,500 — MS67 Wheat cents, select AU–MS Indian Head cents from key decades | $1,500 — 1969-S DDO, 1992 Close AM, modern low-pop MS68+ |

$20,000 | $12,000 — 1909-S VDB (MS65RD), 1914-D (AU58/MS60BN), 1943 Copper (low grade if available) | $5,000 — High-grade semi-keys, MS67+ Wheat cents, MS64–65 Indian Heads | $3,000 — Rare doubled dies, high-population errors, unique Shield cent varieties |

Core holdings secure value and anchor the portfolio with historically stable coins.

Growth holdings target coins with strong appreciation potential as populations shrink in high grades.

Opportunistic buys capitalize on market anomalies and collector fads; higher risk but potentially higher return.

Action Steps

Source coins from reputable auction houses and ANA/PNG dealers only.

Build gradually, prioritizing quality over quantity.

Track each purchase with mintage, grade, price paid, and certification number.

Review market performance every 12–18 months and rebalance if needed.

Conclusion

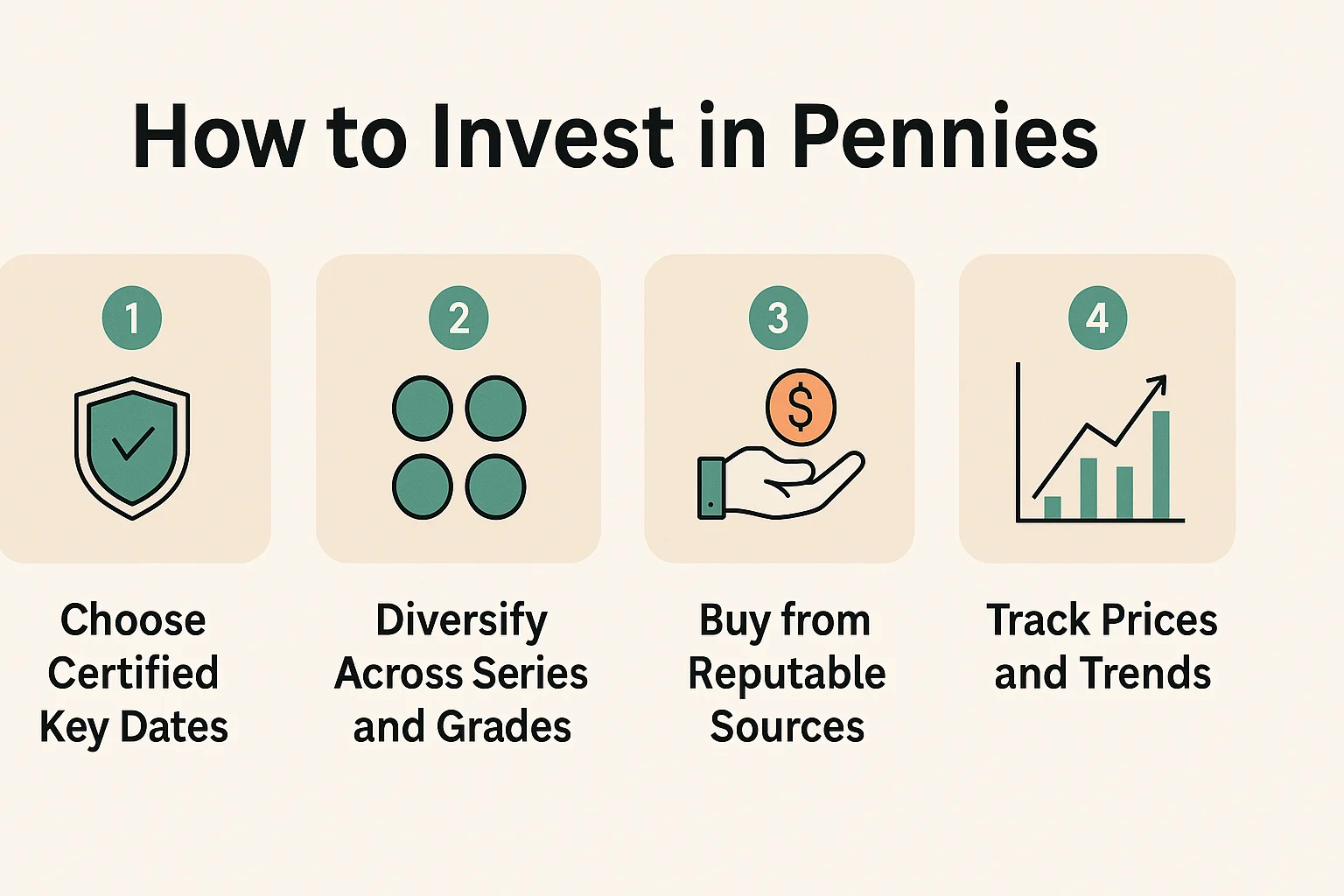

Investing in pennies works best with a clear plan. Start by choosing certified key dates, as these are proven to hold and grow in value. Diversify across different series and grades to balance risk and opportunity. Buy only from reputable dealers or auction houses to avoid counterfeits. Store coins properly in a controlled environment to preserve their condition.

Track market trends so you know when to buy or sell. Patience is essential, as penny values often rise steadily over years rather than months. With discipline and care, pennies can be both a rewarding investment and a piece of history you can hold.